The repo rate in India

Earlier this month, RBI raised the repo rate by 40 basis points to 4.40%, with immediate effect

What is the Repo Rate?

- It is one of several direct and indirect instruments used by RBI for implementing monetary policy.

- It is fixed interest rate at which RBI provides overnight liquidity to banks against the collateral of government and other approved securities under the liquidity adjustment facility (LAF).

- When banks have short-term requirements for funds, they can place government securities that they hold with central bank and borrow money against these securities at the repo rate.

- It serves as key benchmark for lenders to in turn price the loans they offer to their borrowers.

Why is the repo rate such a crucial monetary tool?

- When government, central banks repurchase securities from commercial lenders, they do so at a discounted rate that is known as repo rate.

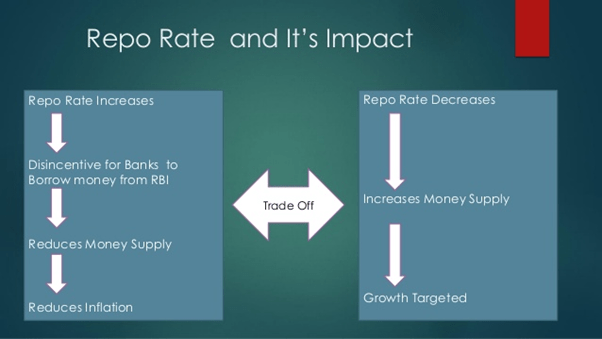

- Repo rate system allows central banks to control money supply within economies by increasing or decreasing the availability of funds.

How does the repo rate work?

- It functions as monetary tool to regulate availability of liquidity or funds in the banking system.

- When repo rate is decreased: banks may find an incentive to sell securities back to the government in return for cash.

- This increases money supply available to general economy.

- When the repo rate is increased: lenders would think twice before borrowing from the central bank at the repo window.

- It reduces availability of money supply in the economy.

- Since inflation is caused by more money chasing the same quantity of goods and services available in an economy, central banks tend to target regulation of money supply as a means to slow inflation.

Impact of repo rate change on inflation

- Inflation can broadly be: mainly demand driven or result of supply side factors.

- Supply side factors push costs of inputs used by producers of goods and providers of services.

- It spur inflation, or most often caused by a combination of both demand and supply side pressures.

- Changes to the repo rate to influence interest rates and the availability of money supply majorly work only on demand side.

- It makes credit more expensive and savings more attractive and therefore dissuading consumption.

Exam track

Prelims take away

- Open Market Operations

- Repo rate

- Reverse repo rate

- Liquidity Adjustment Facility