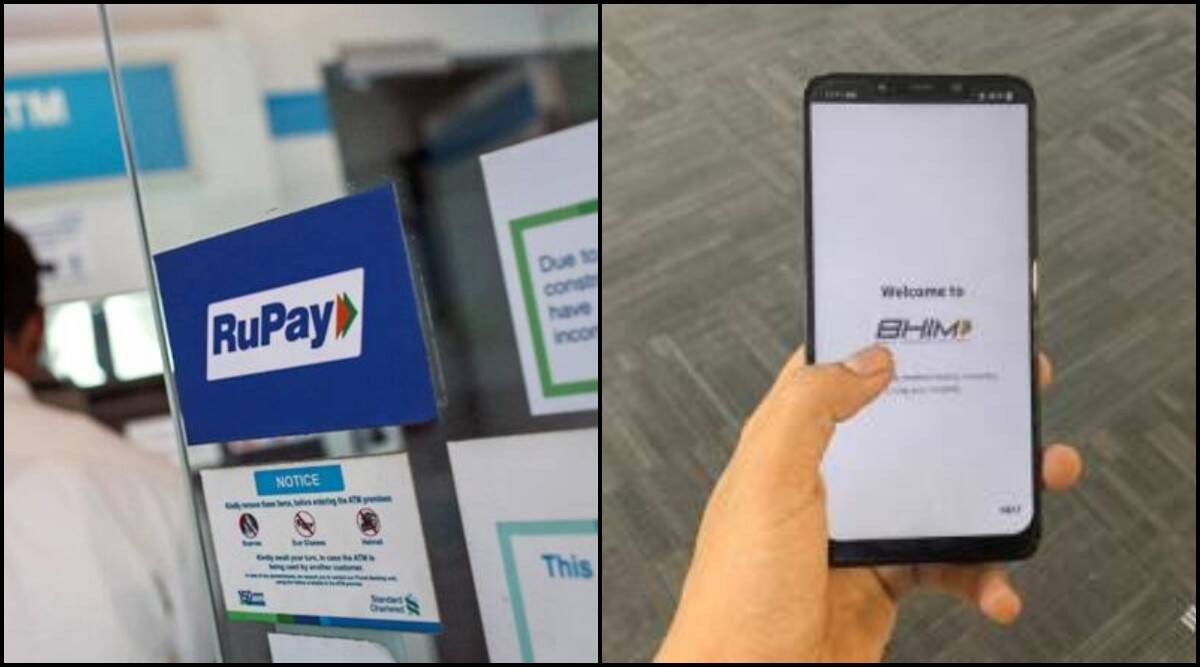

Reimbursement scheme for RuPay Debit Card, BHIM UPI transactions

- The Union Cabinet announced on Wednesday that it has approved a scheme to provide incentives of small amounts for transactions done through the RuPay Debit Card and BHIM UPI.

- The Government will reimburse transaction charges levied on digital payments made by persons to the merchant as part of the merchant discount rate (MDR)"

What is MDR?

- MDR (Merchant Discount Rate) is basically a fee that a merchant is charged by their issuing bank for accepting payments from their customers via credit and debit cards

- In Budget 2020-21, the government prescribed zero Merchant Discount Rate (MDR), the rate merchants pay to scheme providers, for RuPay and UPI, both NPCI products, to popularise digital payments benefiting both customers and merchants.

Digital Payment

- Digital payments have found strong ground, especially in India, increasingly relegating all other modes of payments to the background.

- It is through a faster system of simultaneous debits and credits that the money value is transferred from one account to the other across banks.

- It embraces all kinds of operators (including direct benefit transfer by the government) across the country and even internationally, subject to regulatory forbearance.

- According to a report, Indian digital payment industry is expected to reach $1 trillion by 2023.

Evolution of digital payments in India: steered by the RBI:

- There is a long and interesting history behind the evolution of digital payments in India, piloted by the Reserve Bank of India (RBI) and succinctly captured in the Payment Systems in India, published in 1998.

- A major thrust toward large value payments was affected through the Real Time Gross Settlement System, or RTGS, launched by the RBI in March 2004.

- Introduction of National Electronic Funds Transfer (NEFT) and bulk debits and credits to support retail payments around the same time.

- Now, NEFT is available round the clock and RTGS will follow from December 2020 only a few countries have achieved this.

- Time Bound Settlements: Today, the Securities and Exchange Board of India (SEBI), the market regulator, is contemplating a T+1 settlement (T is for transaction date) because the underlying consideration of the sale proceeds of the shares get exchanged very fast under the payments system.