Covid, lockdown hit MSMEs hardest, their bad loans spiked

- The slowdown in the economy in the wake of the Covid pandemic hit MSMEs the most despite a host of loan restructuring schemes and packages announced.

- MSMEs loan defaults: rose by Rs 20,000 crore to Rs 1,65,732 crore as of September 2021 from Rs 1,45,673 crore in September 2020.

- Bad loans of MSMEs now account for 9.6% of gross advances of Rs 17.33 lakh crore as against 8.2% in September 2020.

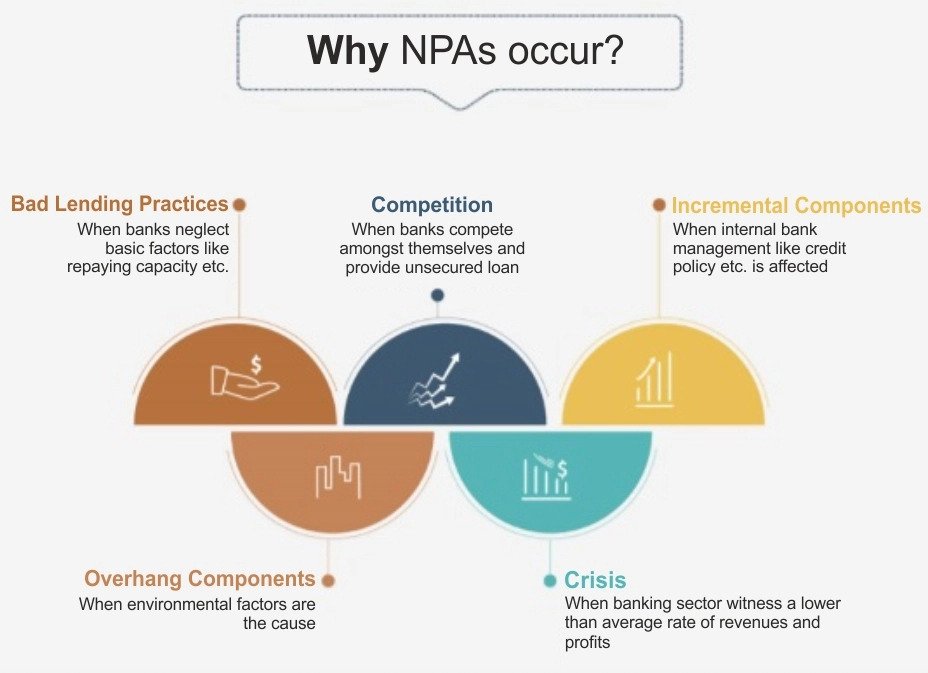

Non-performing Assets (NPAs)

- NPA is any asset of a bank which is not producing any income.

- In other words, a loan or lease that is not meeting its stated principal and interest payments.

- NPA categories:

- Sub-standard: When the NPAs have aged <= 12 months.

- Doubtful: When the NPAs have aged > 12 months.

- Loss assets: When the bank or its auditors have identified the loss, but it has not been written off.

Micro, Small, Medium Enterprises (MSME’s)

- These are entities that are involved in production, manufacturing and processing of goods and commodities.

- The concept of MSME was first introduced by the government of India through the Micro, Small & Medium Enterprises Development (MSMED) Act, 2006.

- The services provided by the Ministry of MSME:

- Facilities for testing, training for entrepreneurship development

- Preparation of project and product profiles

- Technical and managerial consultancy

- Assistance for exports

- Pollution and energy audits.

Reason for defaults

- Thousands of MSMEs either shut down or became sick after the government announced a nationwide strict lockdown in March 2020.

- RBI and the government launched the Emergency Credit Line Guarantee Scheme (ECLGS) which provided Rs 3 lakh crore of unsecured loans to MSMEs and business.

- The restructuring schemes and packages didn’t benefit thousands of units which were already in default.

Conclusion

- The sector acts as the instrument of inclusive growth empowering the most vulnerable and marginalized groups and contributes over 28% of the GDP and almost 45% to the manufacturing output.

- In order to govern the country in an inclusive manner, the government needs to take required measures to solve these NPA problems on an urgent basis.